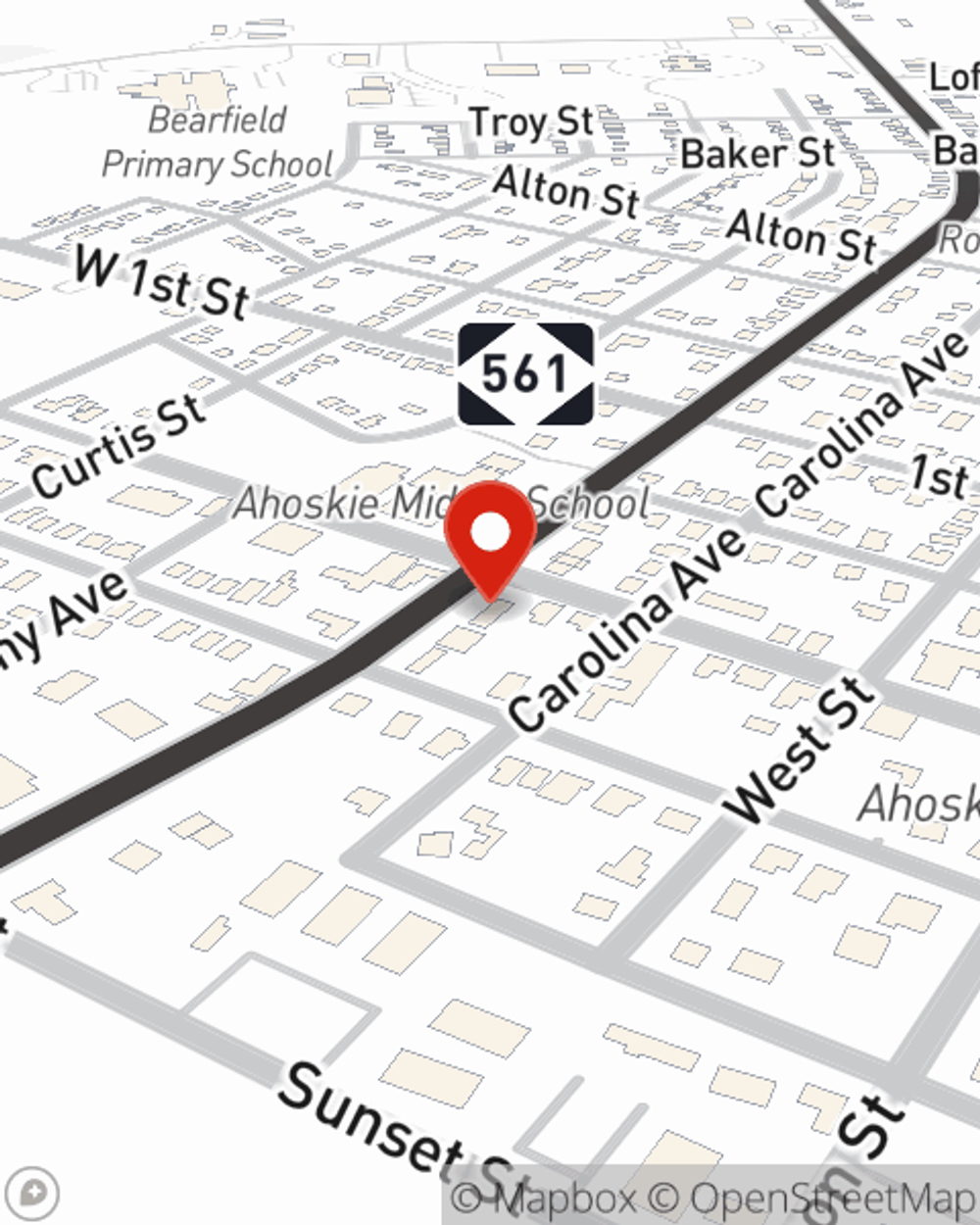

Business Insurance in and around Ahoskie

Ahoskie! Look no further for small business insurance.

Cover all the bases for your small business

- Ahoskie

- Gates County

- Hertford County

- Murfreesboro

- Winton

- Cofield

- Como

- Eure

- Windsor

- Gates

Your Search For Reliable Small Business Insurance Ends Now.

When you're a business owner, there's so much to keep track of. We get it. State Farm agent Wendy Ruffin-Barnes is a business owner, too. Let Wendy Ruffin-Barnes help you make sure that your business is properly insured. You won't regret it!

Ahoskie! Look no further for small business insurance.

Cover all the bases for your small business

Strictly Business With State Farm

For your small business, whether it's a photography business, a shoe store, a fabric store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like equipment breakdown, business property, and buildings you own.

Visit State Farm agent Wendy Ruffin-Barnes today to experience how one of the leaders in small business insurance can safeguard your future here in Ahoskie, NC.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Wendy Ruffin-Barnes

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.